Portag3’s Executive Chairman, Paul Desmarais III, and CEO, Adam Felesky, kick off the 2019 Portag3 Ecosystem Conference with a fireside chat.

Last week, Portag3 Ventures held its 2nd annual Ecosystem Conference in conjunction with the Canada Fintech Forum.

In its seventh edition, the Canada Fintech Forum, which is the country’s largest financial technology conference, attracted over 3,000 attendees from the financial services industry. For the second consecutive year, our Executive Chairman, Paul Desmarais III, served as the forum’s Honorary Chair.

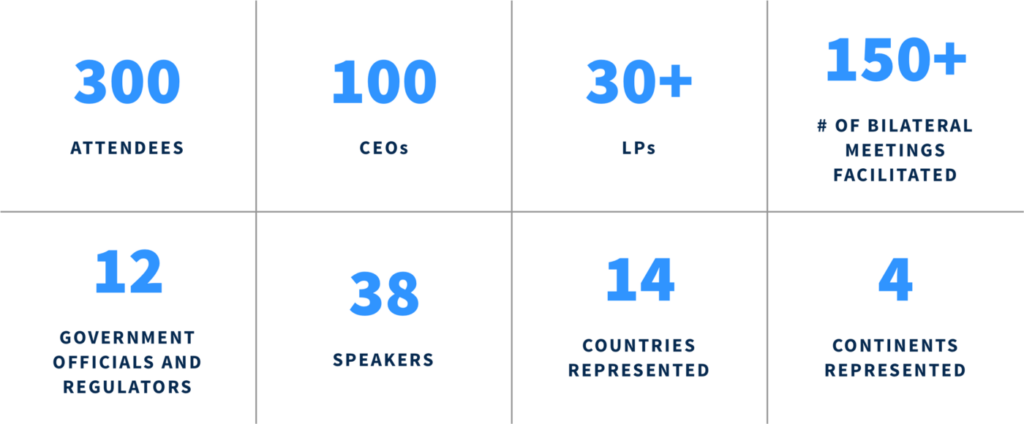

This year, we opted to organize an event that went beyond our traditional investor meetings and catalyzed a significant number of connections within our ecosystem. This meant inviting CEOs and senior leaders from our limited partners (“LPs”), portfolio companies, other financial institutions, fintech startups, VCs, government officials, and regulators from around the world. This resulted in a carefully curated cross-section of leaders who, we felt, could learn, invest, and partner with one another.

Over the course of two days, we convened members of our ecosystem with two goals in mind:

- Drive learning through the discussion of important topics shaping the future of the financial services industry; and

- Create opportunities for our guests to build and strengthen relationships, while driving commercial value for their businesses

While both are incredibly important, we optimized for our second goal of helping foster connections between our guests.

At Portag3 Ventures, our mission is to connect opportunities with talent, capital, and our network. We aspire to be the best partner to all stakeholders who we work with — be they entrepreneurs building the companies we back or LPs who have entrusted us with their capital to help deliver attractive returns and strategic insights. We believe that our network plays an important role in driving success within our financial services portfolio and that we are in a unique position to assemble an interesting group of people from our ecosystem and catalyze commercial outcomes.

Connections, Connections, Connections

We believe that strategic returns will help catalyze financial returns and we do this by facilitating partnerships and collaboration opportunities between our LPs and portfolio companies. To drive this, we have created a Partnerships team at Portag3 led by Ben Harrison (Partner, Head of Partnerships & Policy), primarily focused on:

- Partnerships: work together with our portfolio companies and LPs to generate tangible benefits, enable growth, and execute upon their partnership strategies;

- Insights: provide LPs with actionable insights on innovation, fintech, and technology developments for competitive advantage; and

- Collaboration: leverage our resources to advance innovation and digital transformation strategic priorities

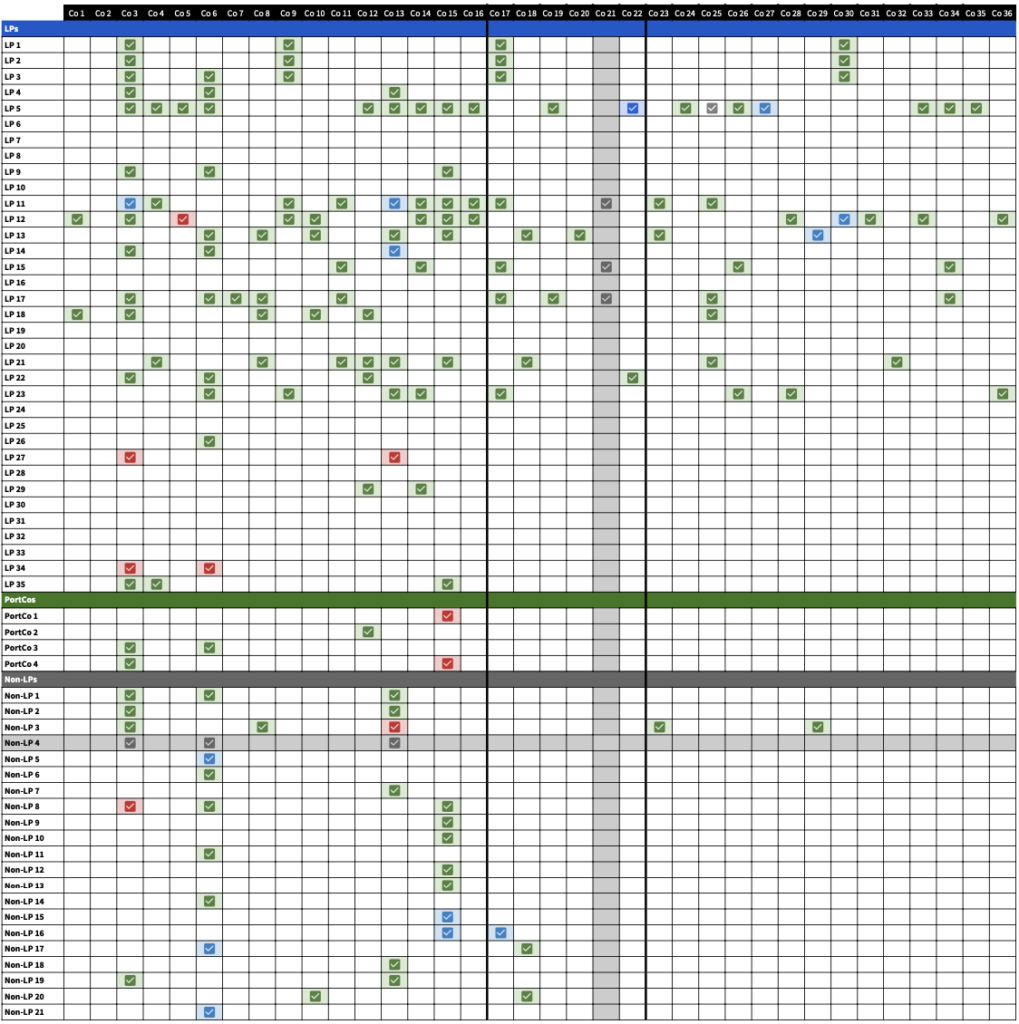

At our event, we set out to curate meetings and make introductions between all of our LPs, portfolio companies, other fintechs, financial institutions, and investors who were in attendance. This resulted in over 150 facilitated meetings between our guests. This was done with the aim of helping spur future business development, partnership, and investment opportunities because our view is that we all win when we work together.

Outside of these facilitated one-on-one meetings, the Portag3 team carefully curated all seating arrangements throughout the conference maximizing opportunities for people to have chance collisions. Given the quality of the guests, this drove substantial commercial benefits. Whether it was seating insurtech companies with carriers and advisors or wealth managers with companies democratizing access to alternative investments, we think this extra touch goes a long way in creating meaningful relationships.

Learning from Financial Technology Leaders

The ecosystem conference was structured into two themes that we spend a significant amount of time thinking about: (1) The Digital Transformation of Banking and Insurance; and (2) Wealth Management & Investing.

The Digital Transformation of Banking and Insurance

When it comes to the transformation of banking and insurance, we see incumbents increasingly partnering with fintechs to form symbiotic relationships to reduce costs, meet evolving customer needs, and capture higher share of wallet. At the same time, there is an uptake in the rebundling of fintechs to compete with the full-service offerings of incumbents. Insurance is in the midst of a ‘Cambrian Explosion’, characterized by a proliferation of new forms, shapes and structures of insurance companies, vendors and processes that touch all aspects of the insurance industry value chain. Outsourcing and partnering is nothing new in the world of business but the digital age is affecting how companies — both large and small — are thinking about it and the role it can play within their business.

Wealth Management & Investing

Within wealth management, technology has lowered the barriers to entry for first-time investors. The next generation of investors are beginning to see the emergence of new, more esoteric asset classes with innovative new investment models in collectibles such as art, wine, cars, sneakers, and increasingly in crypto assets. Alternative assets, which have historically been reserved for large institutions with significant long-term capital, are becoming available to retail investors via a range of new platforms. Despite the many barriers to entry and the product, technological, and regulatory changes needed to grant access, there is increased demand for the democratization of alternative investments — be it in private markets or today’s popular sneakers. Finally, with customer expectations evolving rapidly, the role of the advisor is ever-shifting and new solutions are facilitating these transitions.

We were grateful to have had world-class speakers and fintech leaders join us at the event to speak about the following topics:

- Bring Me Your Complaints: Transforming Negatives to Positives in the Digital Age | Marcia Tal (CEO of Tal Solutions and Founder of PositivityTech)

- The Great Rebundling (of Financial Services) | Mike Katchen (Co-Founder & CEO of Wealthsimple), Yves-Gabriel Leboeuf (Founder & CEO of Flinks), Mahima Poddar (Senior Vice President, Digital Banking and Strategy at Equitable Bank), Michael Stephan (Co-Founder & COO of Raisin), and Stephanie Choo (Partner, Head of Investments at Portag3)

- Democratization of Investing — The Next Generation of Asset Classes | Christopher Bruno (Founder & CEO of Rally Road), Cole Diamond (Chairman & CEO of Coinsquare), Howard Lindzon (Co-Founder & General Partner of Social Leverage), and Melissa Gasser (Principal at Portag3)

- The Cambrian Explosion (in Insurance) | Christopher Oster (Co-Founder & CEO of Clark), Jean-Charles Velge (Co-Founder of Qover), Ian Jeffrey (Co-Founder & CEO of Breathe Life) | Caribou Honig (Chairman & Co-Founder of InsureTech Connect)

- Transformation of Financial Advice and Search for Differentiation | Mark Evans (Founder & CEO of Conquest Planning), Michael Abelson (EVP, Corporate Development at AssetMark), JF Courville (CEO of Wealthsimple for Advisors at Wealthsimple), Tash Elwyn (President & CEO of Raymond James & Associates) | Paul Desmarais III (Executive Chairman of Portag3 Ventures)

- Outsourcing & Partnering in the Digital Age | Frédéric Jousset (Co-Founder and Co-Chairman of WebHelp), Nils Mahlow (Founder & CEO of Claimsforce), Madhav Mohan (Principal, Advisory Services at EY), Adam Stedham (President of GP Strategies) | Fabrice Morin (EVP, Canadian Operations at Canada Life)

- Alternative Investments for Retail Investors | James Waldinger (CEO of Artivest), Alastair Cairns (Head of Insights at Addepar), Craig Birk (Chief Investment Officer at Personal Capital), Nick Veronis (Co-Founder & Managing Partner, Head of Research & Due Diligence at iCapital Network), Dan Parant (Director, Client and Partner Group, KKR), Bryan Mullin (Head of Alternative Investments at RBC), and Paul Desmarais III (Executive Chairman of Portag3 Ventures)

- Cybersecurity: Safeguarding the Financial Services Industry | Robert Masse (National Resilience Leader, Cyber Risk at Deloitte)

Our event concluded with a private CEO dinner that was attended by 200 people where we enjoyed an incredibly engaging discussion between Paul Desmarais III and David Fialkow, Co-Founder and Managing Director at General Catalyst and Academy Award winner in 2018 for Best Documentary awarded for his work on Icarus.

To all who were in attendance, we thank you for taking the time and investing two of your valuable days with us in Montreal.

Until next year (please save the date of the 2020 Canada Fintech Forum — September 14–16, 2020).

About Portag3 Ventures

Portag3 Ventures is the venture capital arm of multi-strategy alternative asset manager, Sagard Holdings. We are an early-stage investor dedicated to backing the next generation of innovative, global financial services companies. We have a global presence with team members in Toronto, Montreal, New York, Europe, and Southeast Asia.