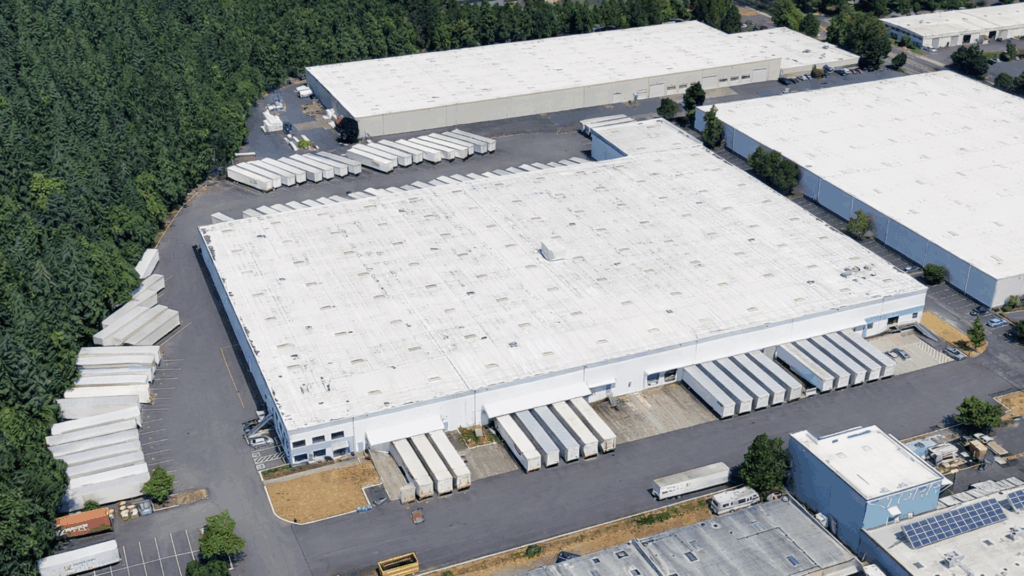

Sagard Real Estate Acquires Class A Miami Industrial Asset, Expanding U.S. Industrial Portfolio

Feb 25, 2026

Feb 25, 2026

Jan 14, 2026

Jan 7, 2026

May 21, 2025

Feb 25, 2026